Selling investment property tax calculator

Use AARPs Investment Property Calculator. Easements some insurance reimbursements and other tax deductions like personal property deductions can also decrease your tax basis.

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

If You Decide To Accept The Offer You Can Pick the Move Date.

. Simple steps when preparing your return. There two possible capital gains tax scenarios that can occur depending in whether you sell. Plan Your Property Investment The Returns With AARPs Investment Property Calculator.

Rental property investment refers to the investment that involves real estate and its purchase followed by the holding leasing and selling of it. This handy calculator helps you avoid tedious number. Find Fresh Content Updated Daily For Selling investment property tax.

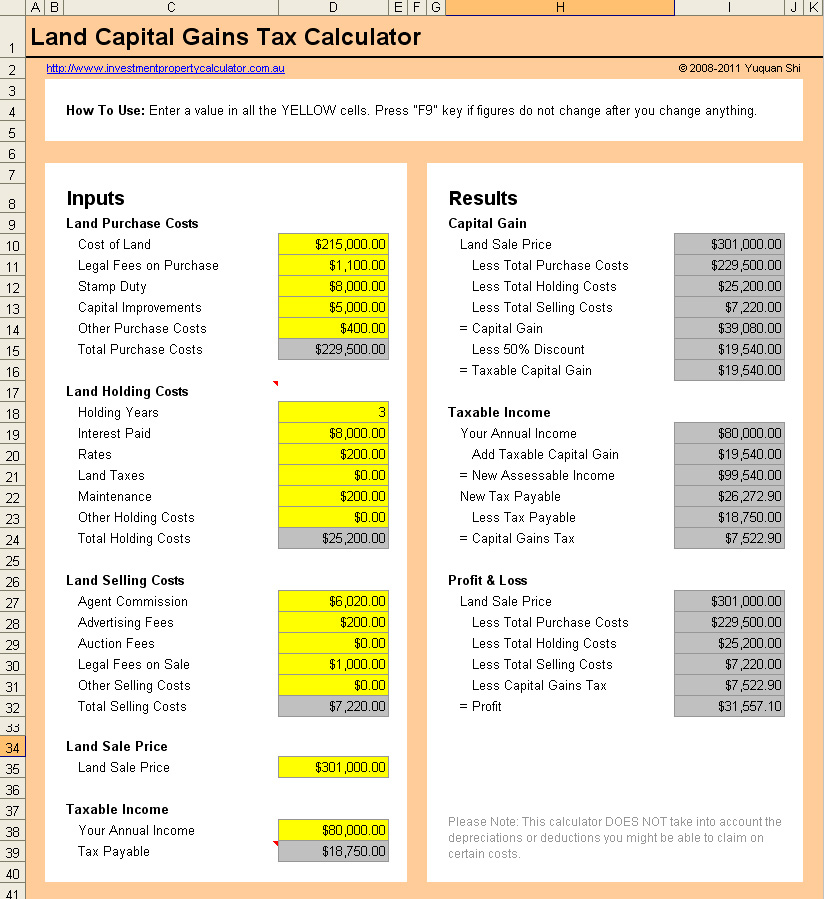

The average cumulative sales tax rate in Ardmore Oklahoma is 913. Assume you purchase a property in Sydney for 500000 and then decide to sell it for 600000. You sold your investment property for 600000 Your current taxable income is 95000 Your capital gain profit is 50000 Your taxable capital gain is 25000 with the 50 CGT discount.

Website 7 days ago 2022 Capital Gains Tax Calculator. Sales tax in Tulsa Oklahoma is currently 852. If you own the property for 12 months or more and you are an Australian resident you may be entitled to a 50 discount on tax on the capital gain.

Save Time Hassle. Ad Are You Considering Investing in Property. Ad HomeLight Buys Your Home As-Is In Select Markets.

The sales tax rate for Tulsa was updated for the 2020 tax year this is the current sales tax rate we are using in the Tulsa Oklahoma Sales Tax. This includes the rates on the state county city and special levels. Selling Investment Property Tax Calculator.

2022 Capital Gains Tax Calculator Use this tool to estimate capital gains taxes you may owe after selling an investment property. Ardmore is located within Carter County Oklahoma. 2022 Capital Gains Tax Calculator - 1031Gateway.

But these selling events can trigger significant long-term capital gains tax liabilities. Get Your Free Estimate Now. That tax rate is 15 if youre married filing jointly with taxable income between.

As long as you held the property for at least one year the capital gains tax rate in effect in 2013 is 15 percent -- or 20 percent if your taxable income as a single taxpayer is more. Use this tool to estimate capital gains taxes you may owe after selling an. The great thing is that Swyftx is so simple for novices to use and they even have a totally free Demo Mode that.

Are Closing Costs Tax Deductible On Rental Property In 2022

How To Calculate Real Estate Taxes On Your Property Estate Tax Property Tax Real Estate

How Is Rental Income Taxed The Advantages Of Being An Owner

The Excel Spreadsheets I Use To Manage My Investment Property Income Expenses Tax Deductions The Loan Etc Investing Investment Property Tax Deductions

Property Tax How To Calculate Local Considerations

2022 Capital Gains Tax Rates By State Smartasset

Tax Calculator For Rental Property Cheap Sale 57 Off Www Ingeniovirtual Com

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

3 Ways To Calculate Capital Gains Wikihow

Itr Filing For Fy 2021 22 How To Calculate Capital Gain Tax On Sale Of Property Mint

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Pin On Financial Ideas

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Rental Income Tax Calculator For Landlords Taxscouts

3 Ways To Calculate Capital Gains Wikihow

Converting A Residence To Rental Property

How To Calculate Capital Gains On Sale Of Gifted Property Examples